deferred sales trust problems

There are two situations where the gain all or part cannot be deferred. Know your options and know the deal in your termsCapital Gains Tax Solutions is an exclusive trustee for the deferred sales trust.

Delaware Statutory Trusts A Comprehensive Guide With Pros And Cons

Potential Disadvantages of Deferred Sales Trusts A couple of possible pitfalls with deferred sales trusts include.

. It doesnt work for things like crypto currency like the deferred sales trust is we just helped a client who exited at 50000 a Bitcoin went up to 50 million. The problems with a Deferred Sales Trust. 1 if the character of the gain realized from the sale is treated as ordinary income because of the depreciation recapture.

Set-up and maintenance fees can also be exorbitant. I want you to. The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time.

And so she had a large gain. A deferred sales trust can be difficult to launch and. In addition your DST setup and maintenance fees likely will be higher than with some other types of tax deferral strategies.

GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now. It can be difficult to establish and manage a DST. Among the potential pitfalls of deferred sales trusts are.

GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now. Thats where the Deferred Sales Trust comes in. Instead of receiving the sale proceeds at.

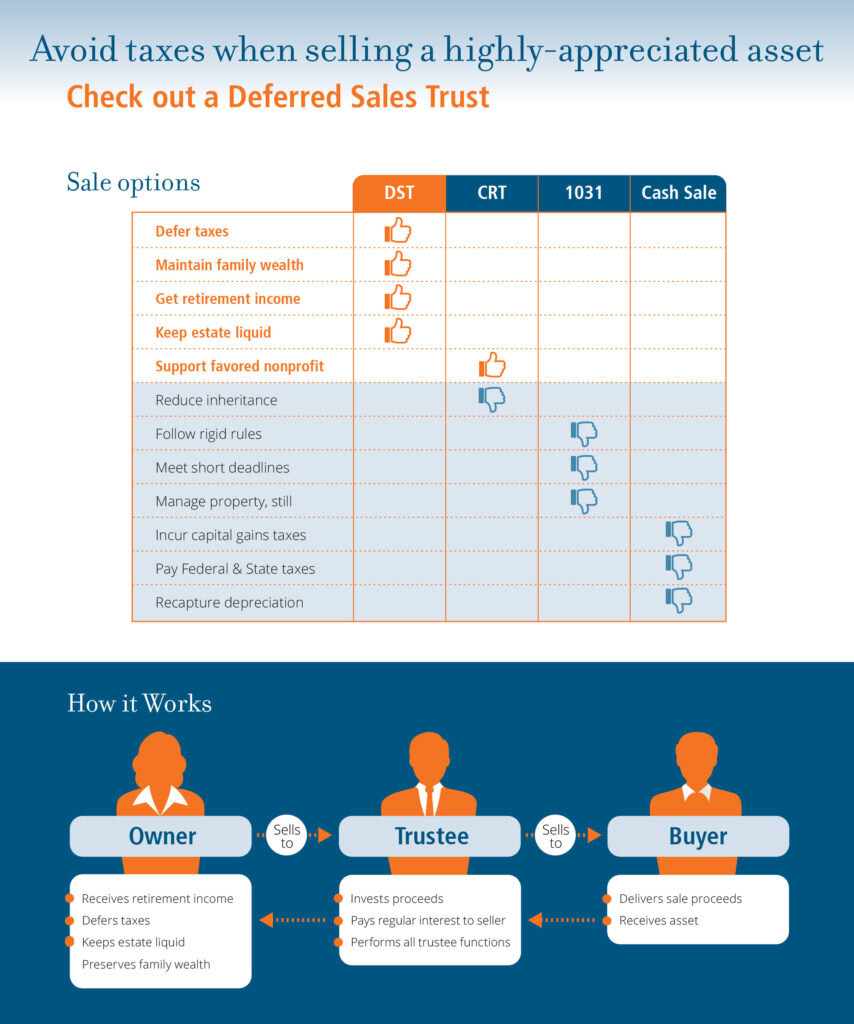

In September 2019 the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who. A deferred sales trust is a method used to defer capital gains tax when selling real estate or other business assets that are subject to capital gains tax. Tax Issues of the Deferred Sales Trust It is important to do the numbers to make sure that in fact the tax savings are more than the setup and administrative costs.

I want you to better understand how you can benefit from a deferred sales trust so you can make more money when you sell and have more freedom with your time. By using Section 453 of the Internal Revenue Code which pertains to installment sales and related tax provisions it lets people sell a. If a deferred sales trust is improperly managed and the IRS chooses to investigate it is possible that the trust could be designated as a sham trust If a.

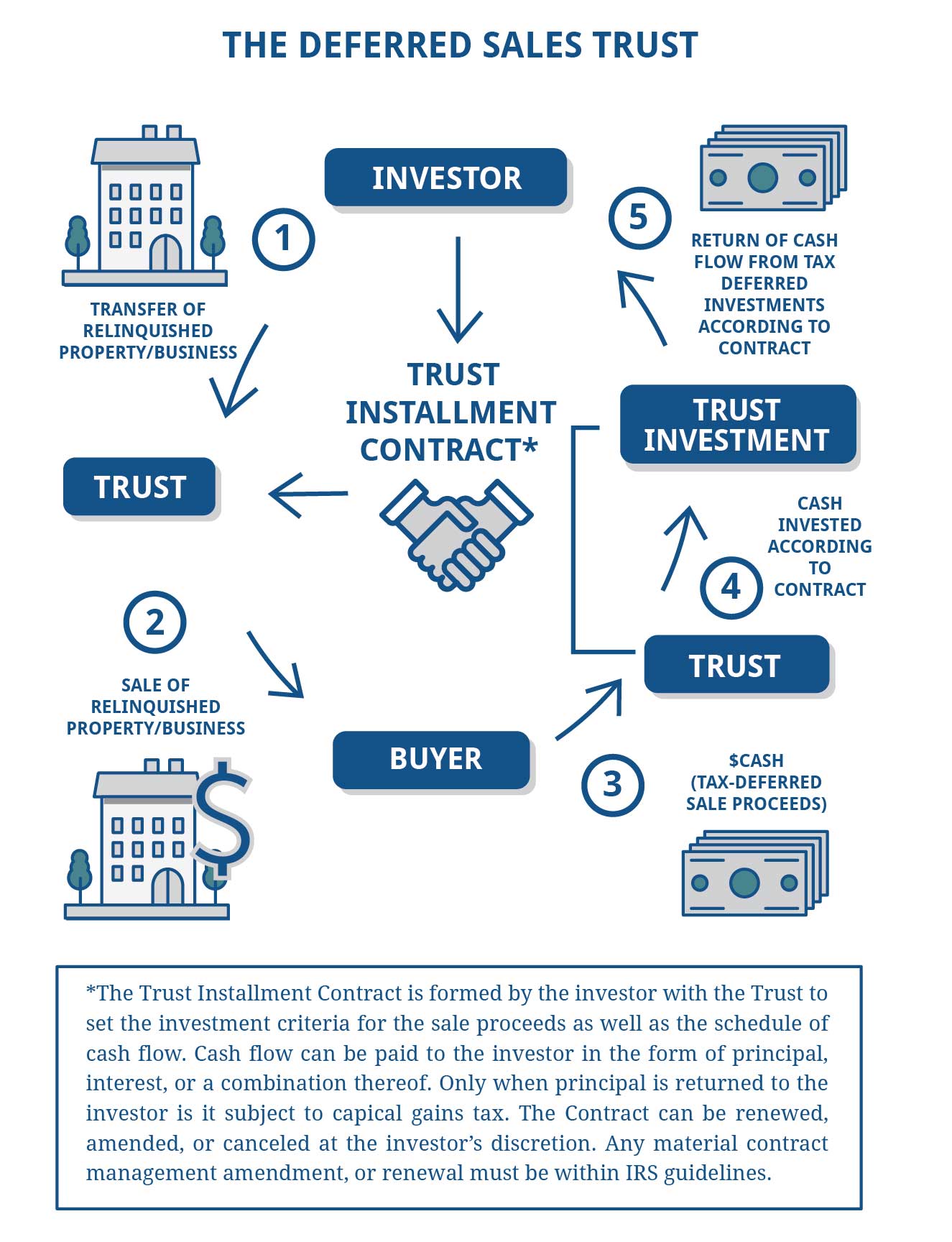

A Deferred Sales Trust is a legal contract between an investor and a third-party trust in which the investors real property is sold to the trust in exchange for predetermined future payments. We are experts and focuse. For instance you can expect to pay the following.

A Deferred Sales Trust is simply a trademark a subset of practitioners use to describe a financial structure that includes an irrevocable trust and an installment sales. Many people that are a part of the legal and 1031 exchange community do not believe this structure is legitimate for the purposes of deferring.

Deferred Sales Trust O Connell Investment And Insurance Services

Deferred Sales Trust Defer Capital Gains Tax

Disadvantages To A Deferred Sales Trust Youtube

Why The Irs Allows Deferred Sales Trusts And How You Can Benefit Reef Point Llc

Small Differences In Mutual Fund Fees Can Cut Billions From Americans Retirement Savings The Pew Charitable Trusts

Could An Intermediated Installment Sale Reduce Your Taxes 1 On 1 Financial

Disadvantages To A Deferred Sales Trust Youtube

Deferred Sales Trust 101 A Complete Guide 1031gateway

Charitable Remainder Trusts Crt Frequently Asked Questions

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Capital Gains Tax Deferral

Benefits And Drawbacks Of Using The Deferred Sales Trust

Deferred Sales Trust The Other Dst

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Sales Trust Everything You Need To Know Life Bridge Capital